Tesla vs. Nissan

Intro/Company Background (Factset)

Tesla, Inc., founded in 2003 by engineers Martin Eberhard and Marc Tarpenning in San Carlos, California, aimed to revolutionize the automotive industry by popularizing electric vehicles (EVs). Elon Musk, who joined the company as an early investor and later became its CEO, provided funding and vision for its long-term strategy. Tesla’s initial success came with the launch of the Tesla Roadster in 2008, the first fully electric sports car to achieve mass production. Following the Roadster, Tesla introduced the Model S in 2012, a luxury sedan that established the company as a leader in EV technology with its groundbreaking range and performance. The releases of the Model X SUV (2015), Model 3 sedan (2017), and Model Y crossover (2020) solidified Tesla’s dominance in the EV market, particularly with the Model 3 becoming the world’s best-selling EV. Tesla’s innovation extends beyond vehicles to energy storage and solar products, with offerings like Powerwall, Powerpack, and Solar Roof. Headquartered in Austin, Texas, Tesla’s vertically integrated business model encompasses vehicle manufacturing, battery production, software development, and a global supercharger network. The company has prioritized sustainability, leveraging economies of scale and innovation to reduce costs and increase adoption of renewable energy solutions. Tesla operates factories in the U.S., China, and Germany, with significant plans to expand its manufacturing and R&D footprint. In addition to its automotive operations, Tesla generates revenue from software services such as Full Self-Driving (FSD) subscriptions, creating recurring revenue streams.

Nissan Motor Co., Ltd., headquartered in Yokohama, Japan, was founded in 1933 by Yoshisuke Aikawa as Jidosha-Seizo Kabushiki-Kaisha, later renamed Nissan. The company emerged as a significant player in Japan’s automotive industry, producing military and passenger vehicles during its early years. Post-World War II, Nissan shifted focus toward mass-market vehicles, with models like the Datsun 510 and the Z sports car, which gained popularity in the U.S. market in the 1970s. In the 1990s, Nissan faced financial difficulties due to overexpansion and high debt, prompting an alliance with French automaker Renault in 1999. Under the leadership of Carlos Ghosn, who became CEO, Nissan underwent a major restructuring, cutting costs and focusing on profitable models. The alliance with Renault and later Mitsubishi allowed for shared technology, R&D, and cost synergies, making it one of the largest automotive groups globally. Nissan was an early entrant into the EV market with the launch of the Leaf in 2010, the first mass-produced electric vehicle, which became a global best-seller. However, the company struggled to maintain its lead as competitors like Tesla and BYD rapidly innovated. Nissan’s focus on affordability and ICE (internal combustion engine) vehicles has been a double-edged sword, as its reliance on low-margin products has limited profitability. Today, Nissan’s portfolio includes a mix of sedans, SUVs, and EVs. The company’s geographic footprint spans Asia, North America, and Europe.

Revenue Breakdown and Geographical Distribution: (Tesla, Nissan Form-10 k)

Tesla’s revenue for the TTM primarily stems from its automotive sales, which contribute approximately $78.5 billion, or 81% of total revenue. This is speared by the Model 3, Y, S, and X offerings, as well as the newly introduced Cybertruck. Regulatory credits, a smaller part of its income, accounted for $1.79 billion (1.85%). Additional revenue streams include leasing ($2.12 billion, or 2.19%), services ($8.32 billion, or 8.6%), and energy generation and storage products such as Powerwall and Megapack, which collectively generated $6.03 billion (6.24%). Geographically, Tesla derives 47% of its revenue from the United States, 30% from Europe, and 23% from China.

Nissan’s revenue, totaling $83.88 billion (TTM), is heavily concentrated in automotive sales, which account for approximately 90% of total revenue. Its electric vehicle segment, led by the Nissan Leaf, contributes a modest 5%, while services, including financing and after-sales offerings, comprise the remaining 5%. Regionally, Nissan relies on Japan for 30% of its revenue, followed by China & Asia-Pacific at 25%, North America at 20%, Europe at 15%, and Laitn America and Middle East at 10%.

Tesla Key Differentiators

Vertical integration

Technological innovation

Brand Awareness

Ecosystem

Nissan Key Differentiators

Established Market presence

Alliances & Partnerships

Affordable cost

(Tesla, Nissan Form-10 k)

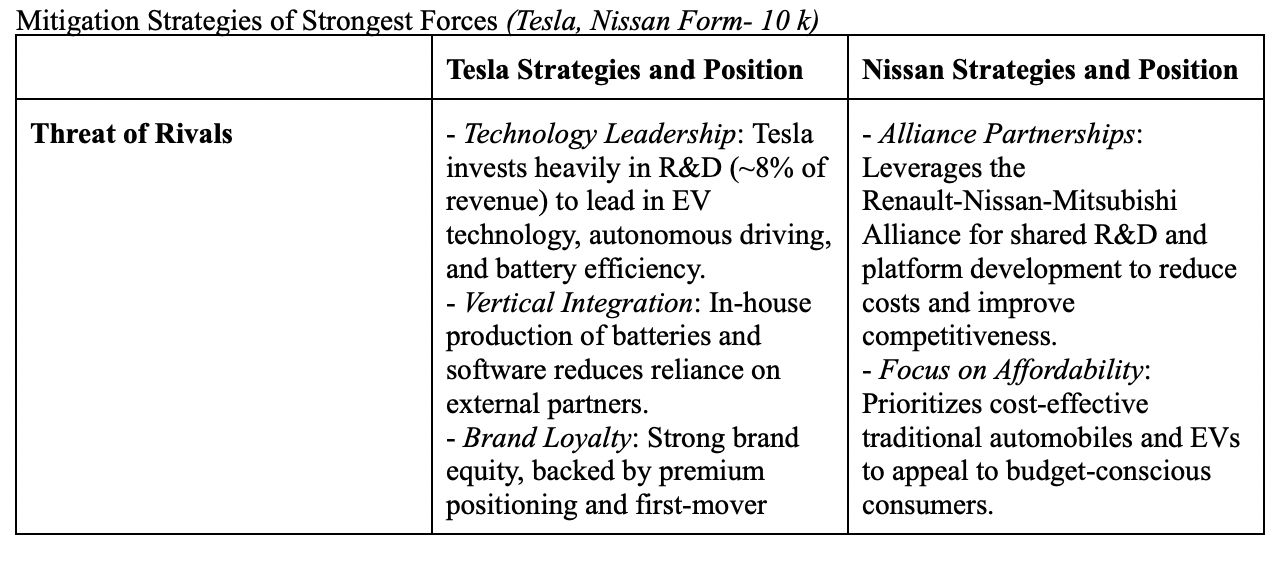

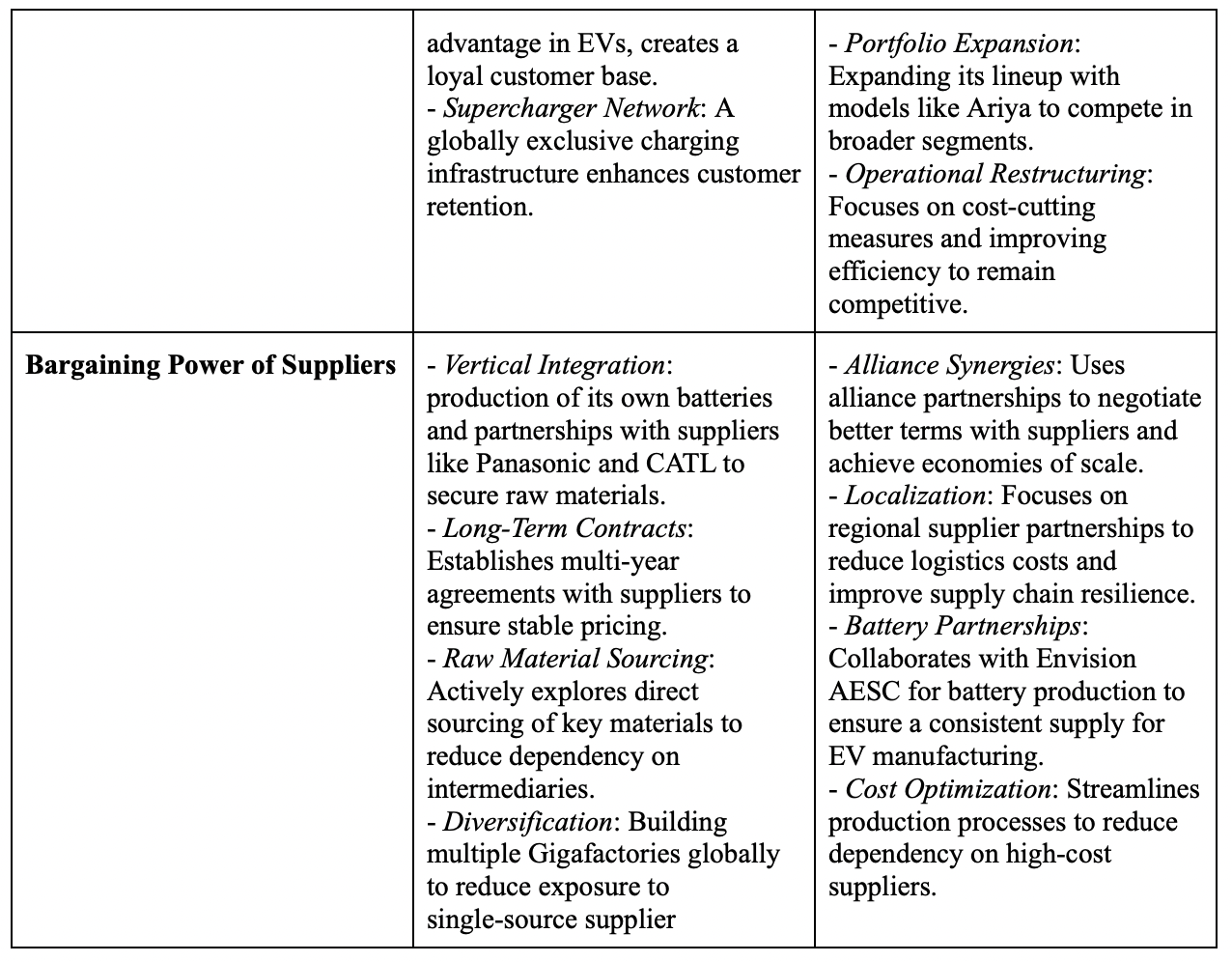

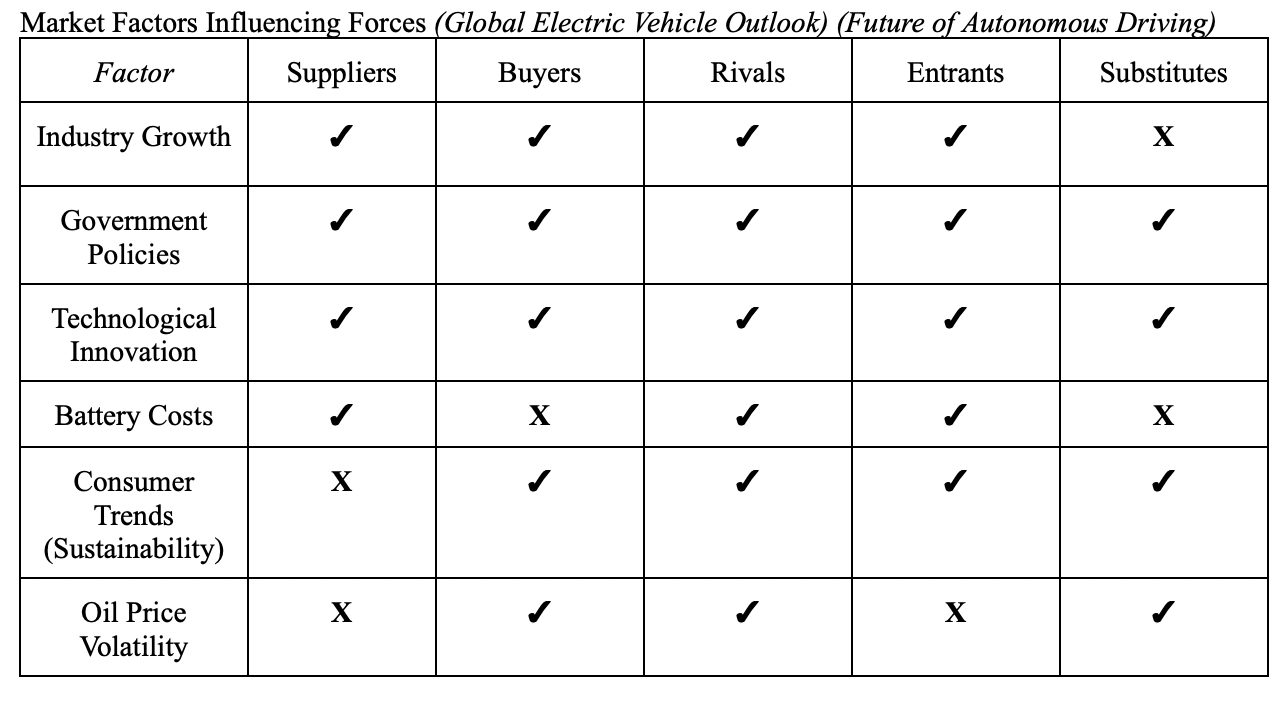

Industry Analysis

Industry Overview (Automotive Industry Trends, PWC) (Automotive Industry Insights, Kroll)

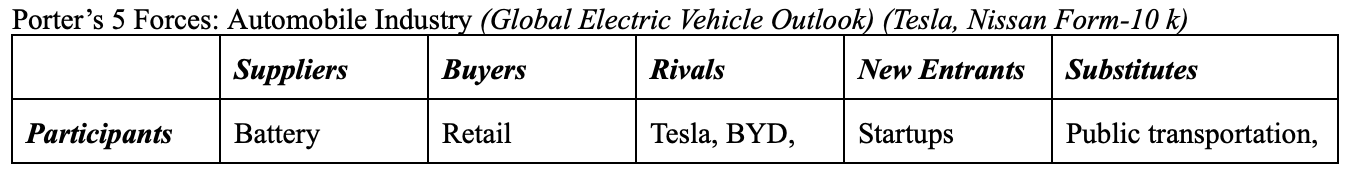

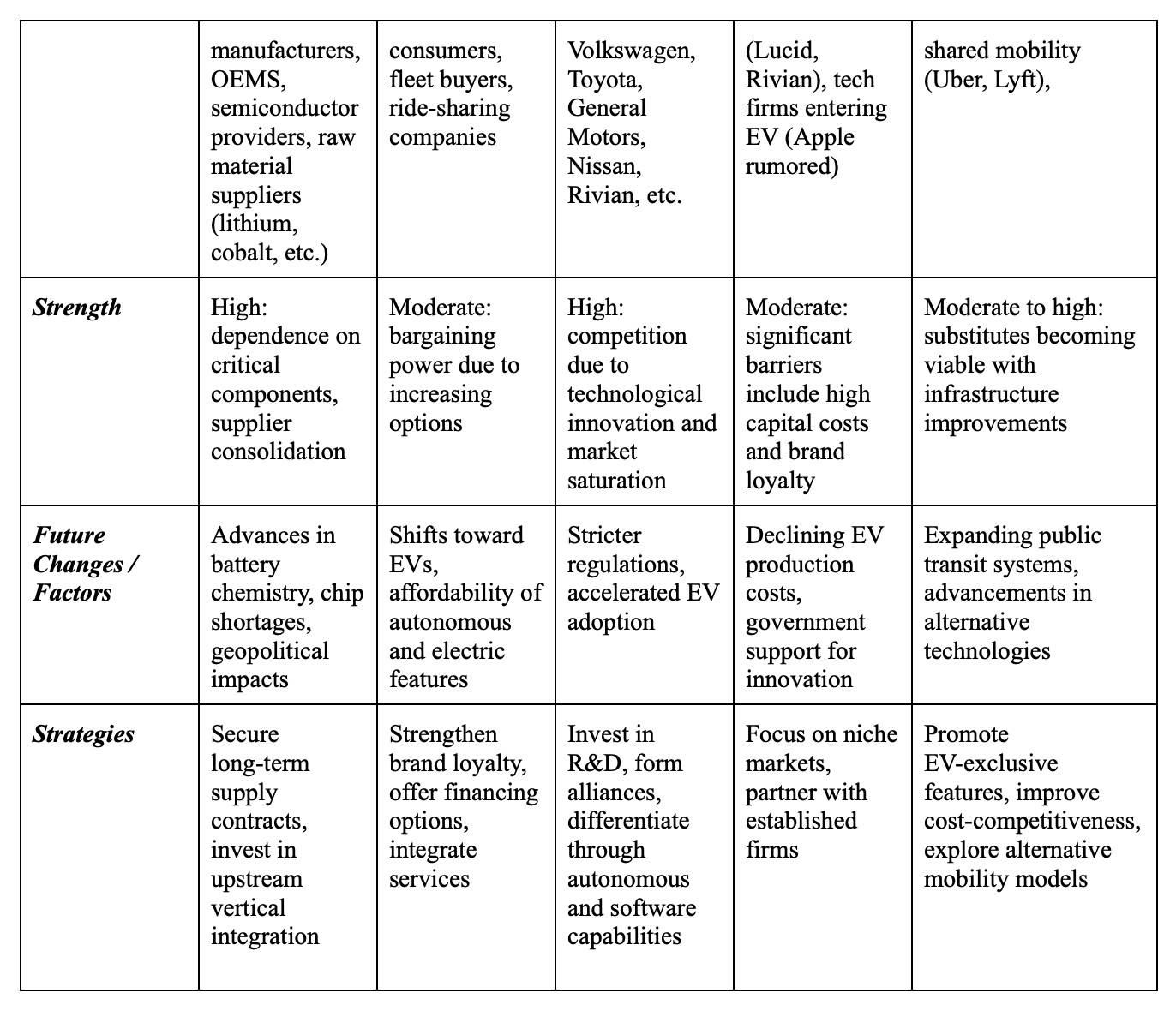

The automobile industry, encompassing both traditional ICE vehicles and the rapidly growing EV sector, represents one of the most dynamic and transformative global markets. This sector includes established legacy automakers such as Toyota, Ford, and Nissan, which have historically dominated through economies of scale and broad product offerings, as well as disruptive EV-only manufacturers like Tesla, and BYD, which are redefining the industry with their focus on electrification, autonomous technologies, and sustainability. The EV market, in particular, has emerged as a key driver of industry growth, driven by regulatory mandates, advancements in battery technology, and shifting consumer preferences toward environmentally friendly transportation. Companies are competing not only on traditional factors such as design, performance, and affordability but also on EV-specific elements like battery. Beyond vehicle manufacturers, the industry also encompasses a vast ecosystem of suppliers and partners, including battery producers, semiconductor manufacturers, and charging infrastructure providers. Collaboration with technology companies is accelerating, particularly in areas like autonomous driving, vehicle connectivity, and over-the-air software updates, which are reshaping the concept of the automobile into a software-driven mobility solution. Additionally, ride-sharing services and emerging mobility platforms are introducing innovative ways to meet urban transportation needs, contributing to a broader redefinition of personal and shared vehicle usage.

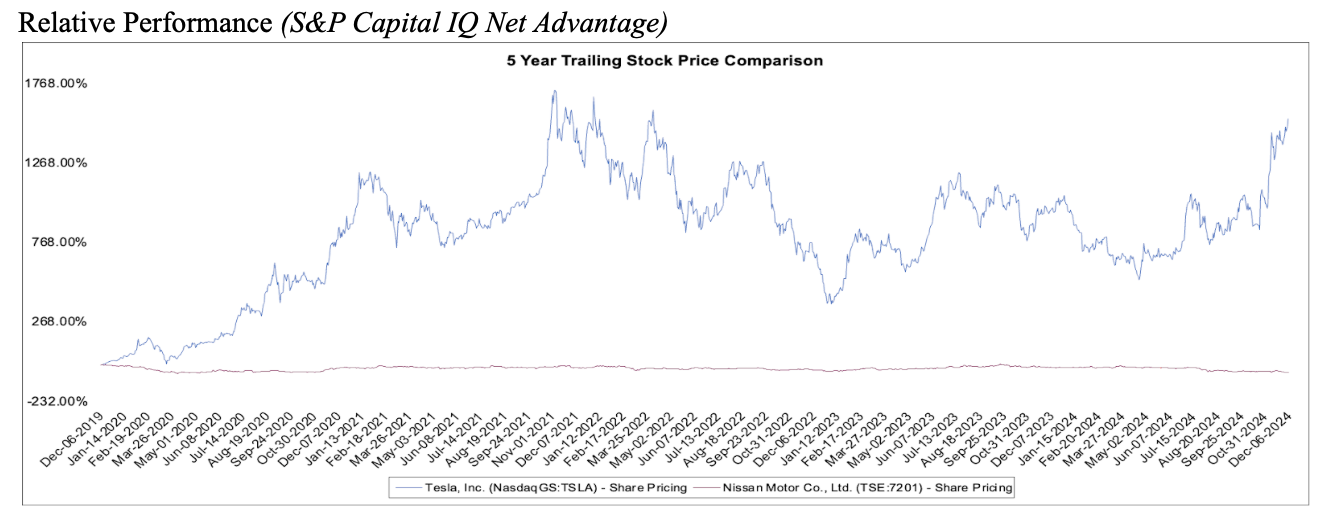

Trends, Players, and Performance (Global Electric Vehicle Outlook) (S&P Capital IQ Net Advantage)

Several key trends are shaping the automotive industry. Electrification continues to dominate, with battery electric vehicles experiencing exponential growth in adoption. Companies like Tesla and BYD are leading the charge, while legacy automakers like Nissan are accelerating their transition to EVs. This evolution is closely tied to innovation in semiconductors, sensors, and vehicle-to-everything communication, which are critical components enabling this transformation. Autonomous driving, spearheaded by players like Tesla, and Cruise, remains a transformative opportunity. Supply chain resilience, especially in critical components like semiconductors and lithium, is another major focus. Government incentives, stricter emission regulations, and advancements in technology are also driving innovation across the industry. These trends show the evolution of the industry, with new players disrupting traditional business models and legacy automakers striving to adapt. Performance within the sector varies widely, with companies like Tesla capitalizing on their early EV dominance, while others like Nissan leverage affordability and mass-market strategies.

Industry Statistics (2024) (Automotive Industry Insights, Kroll)

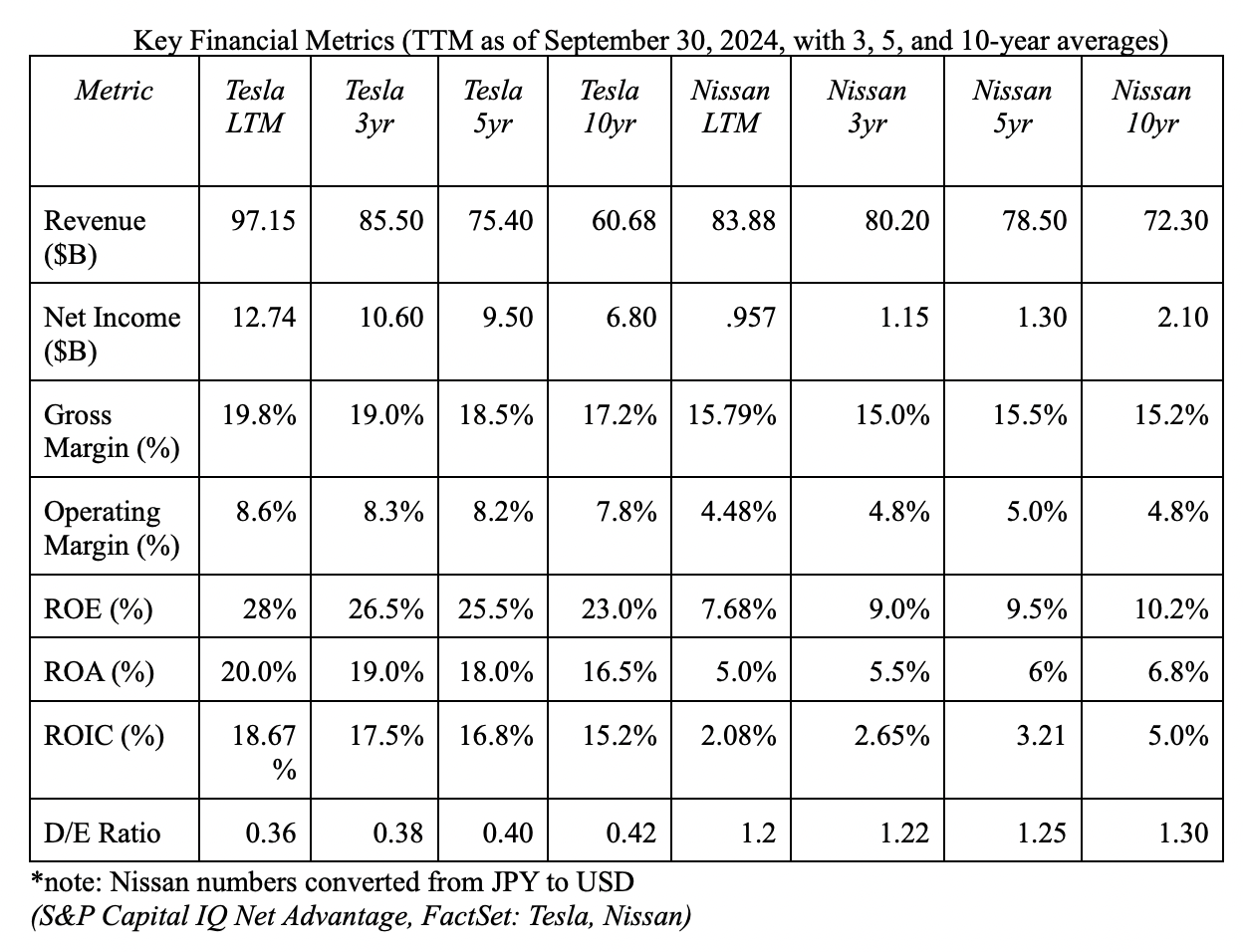

The global automotive market size is approximately $3.8 trillion, with the EV segment alone valued at $1 trillion as of 2024. The EV market is projected to grow at a compound annual growth rate (CAGR) of 20-30% through 2030, outpacing the broader automotive market’s CAGR of 8.7% for the same period. R&D spending in the industry accounts for 2-5% of revenue for traditional automakers, whereas EV-focused companies like Tesla often allocate 5-10%. Key regions include the U.S., China, and Europe, with China leading global EV adoption. ROIC in the industry varies widely, with an average around 5-10%, but industry leaders such as Tesla boast ROIC figures exceeding 18%, reflecting efficient capital allocation and strong operational performance.

Company Analysis: Strategic Positioning, Competitive Advantage, Leadership, Social Responsibility

Strategic Positioning - Tesla (Tesla Form 10 K)

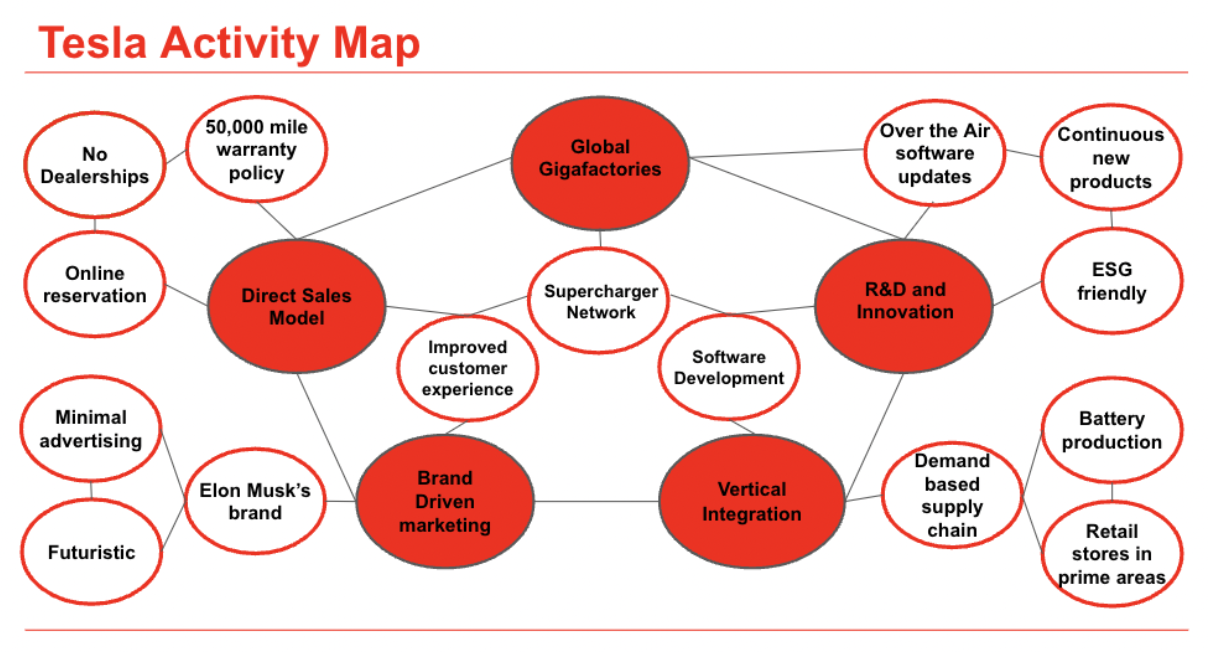

Tesla’s superior performance is rooted in its variety-based strategic positioning, which focuses exclusively on EVs and energy solutions. Unlike legacy automakers, Tesla provides a specific “slice” of the automotive industry, offering cutting-edge EVs with advanced features like long-range batteries and autonomous driving. This narrow product focus enables Tesla to dominate the EV market and establish itself as a leader in sustainable transportation. By avoiding hybrids and ICE vehicles entirely, Tesla achieves economies of scale in EV production while channeling all resources toward innovation. Its vertical integration strategy, which encompasses battery production, software development, and a proprietary charging network, further reinforces its positioning. Tesla’s activity map reflects the coherence of its strategic choices, with interconnected activities like direct sales, global Gigafactories, and brand driven marketing creating synergy and maintaining its leadership in the EV space.

Analysis

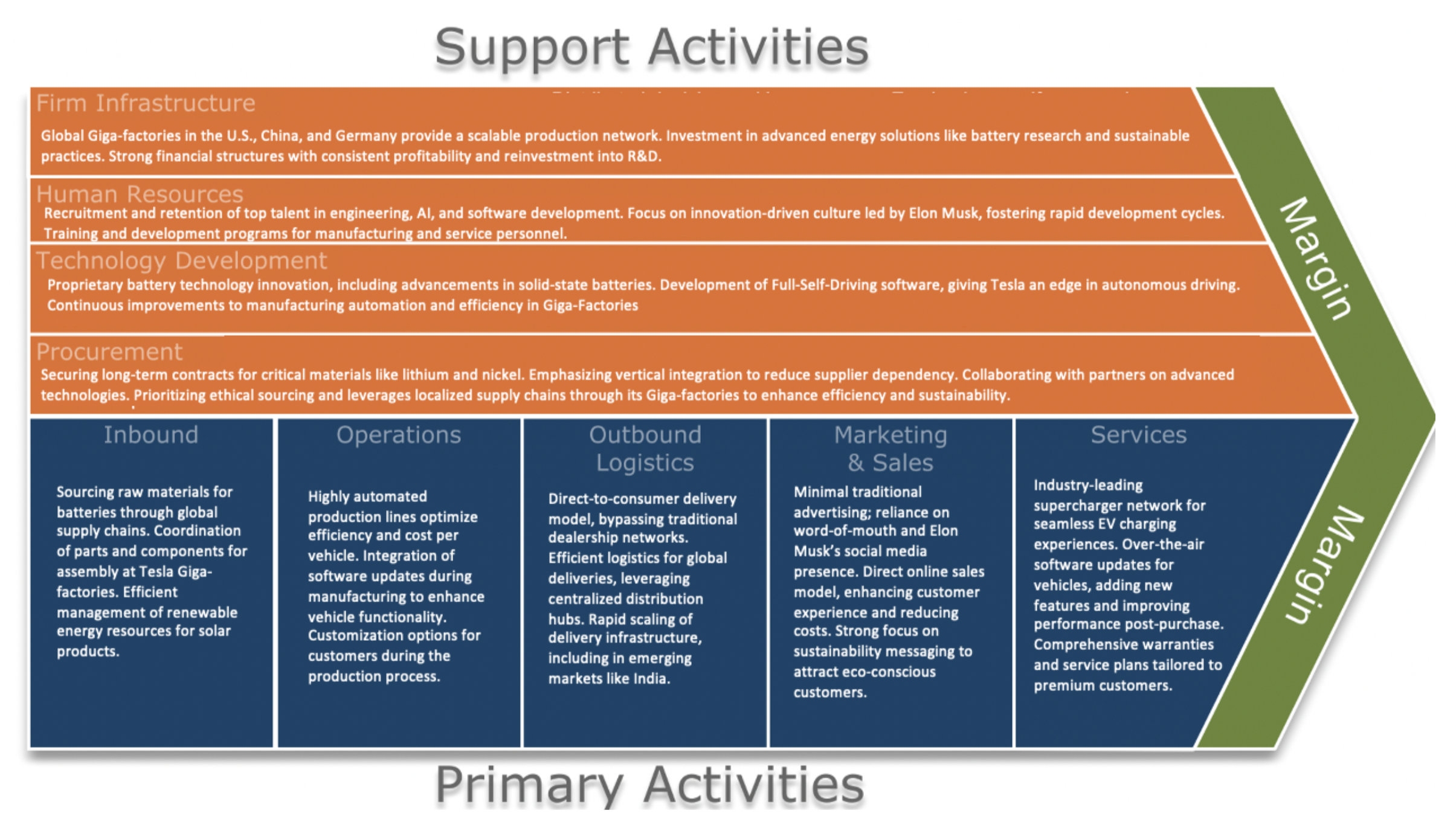

Vertical Integration: Tesla controls battery production, software development, and charging infrastructure through in-house capabilities and partnerships. This reduces costs and enhances differentiation. Tesla has a demand based supply chain, and retail stores in prime areas.

R&D and Innovation: Investing approximately $3.1 billion annually (~8% of revenue), Tesla leads in battery innovation, autonomous driving, and over-the-air updates, all while being ESG friendly.

Global Gigafactories: Tesla operates production facilities in key markets (U.S., China, Germany) to scale production and reduce costs through automation.

Direct Sales Model: Tesla bypasses dealerships with a direct-to-consumer model, ensuring consistent customer experiences and cost efficiencies with favorable warranties and online reservations.

Brand-Driven Marketing: Tesla spends minimal on traditional advertising, relying on Elon Musk’s personal brand and word-of-mouth marketing to enhance visibility and attract premium customers who vie for futuristic products.

Orders of Fit

Tesla demonstrates a high level of alignment between its strategic goals and operational activities, exemplifying first, second, and third-order fit. At the first-order level, Tesla’s activity map directly aligns with its differentiated strategy by integrating battery production, software development, and charging infrastructure. This vertical integration ensures cost control, enhances innovation, and positions Tesla uniquely in the EV sector within the broader automotive industry. Moving to the second-order fit, Tesla’s activities reinforce one another. For example, its R&D investments drive advancements in battery innovation, which supports cost-effective production processes and improves vehicle performance, reinforcing its premium brand equity. Finally, at the third-order fit, Tesla optimizes its efforts through strategic coherence, leveraging its Gigafactories for scalable production while its software offerings generate recurring revenue streams through features like Full Self-Driving. These layers of fit create a sustainable advantage by aligning Tesla’s operational activities with its strategic vision.

Tradeoffs and Sweet Spot

Tesla’s strategic focus on innovation and premium branding has tradeoffs, which it has effectively managed to find its competitive sweet spot. One key tradeoff is Tesla’s prioritization of innovation over affordability, which limits its reach in the mass market but allows it to sustain its premium pricing and reinforce its brand identity. Similarly, Tesla’s focus on premium EVs exposes it to pricing pressure from competitors targeting cost-conscious consumers, such as BYD and Nissan. Another trade off involves heavy investment in R&D, which raises fixed costs and impacts short-term profitability but ensures Tesla’s long-term leadership in autonomous driving and battery technology. Tesla also avoids hybrid vehicles entirely, limiting diversification opportunities compared to competitors with mixed portfolios.

Despite these tradeoffs, Tesla’s sweet spot lies in maximizing R&D to sustain premium brand equity, focusing exclusively on EVs to reinforce differentiation, and leveraging vertical integration. Tesla further enhances customer loyalty through its global supercharger network and subscription-based software services, creating a robust ecosystem that increases willingness to pay and reduces switching costs. By aligning its strategy with these focused priorities, Tesla has established itself as a leader.

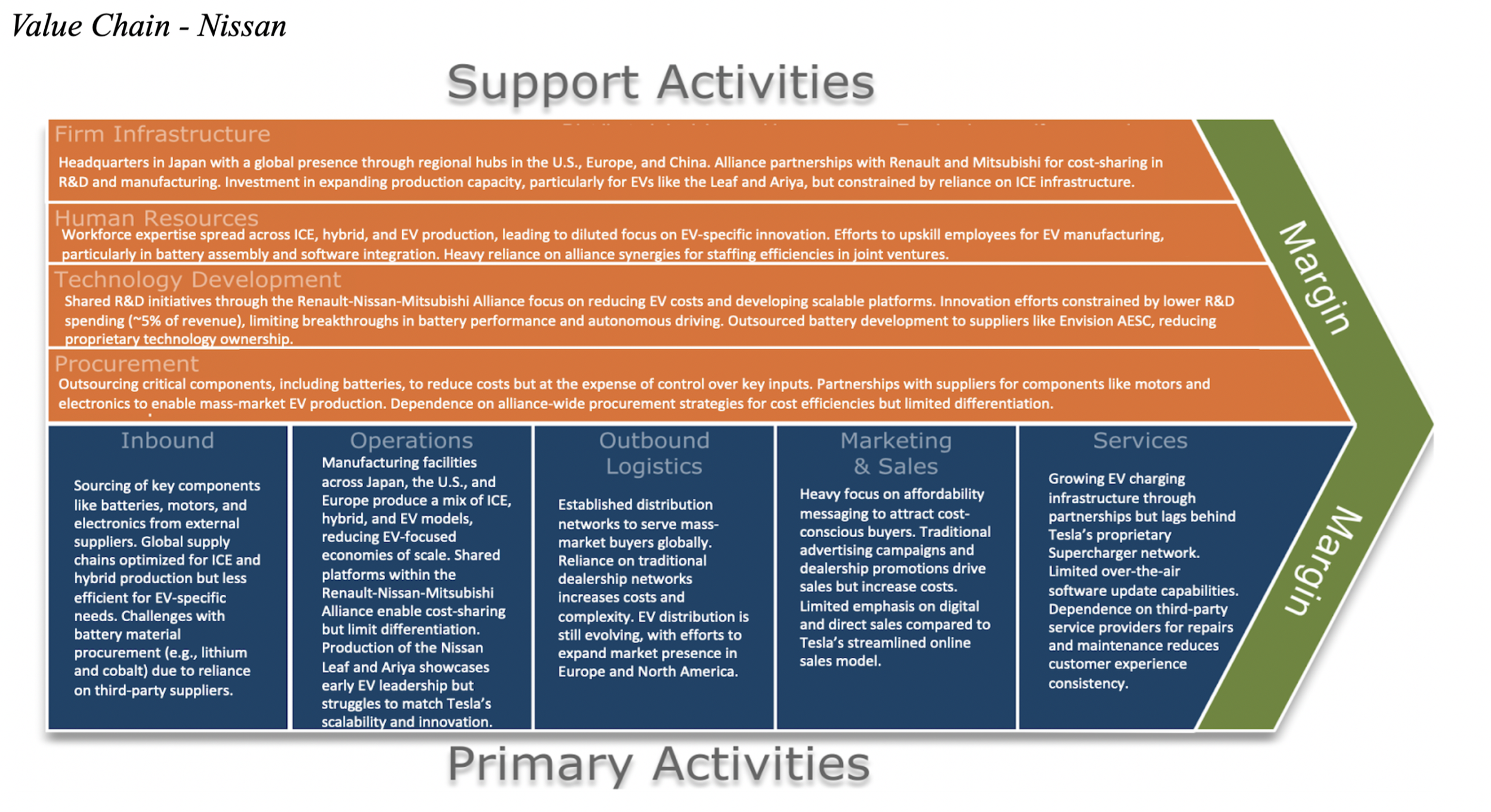

Strategic Positioning - Nissan (Nissan Form 10 k)

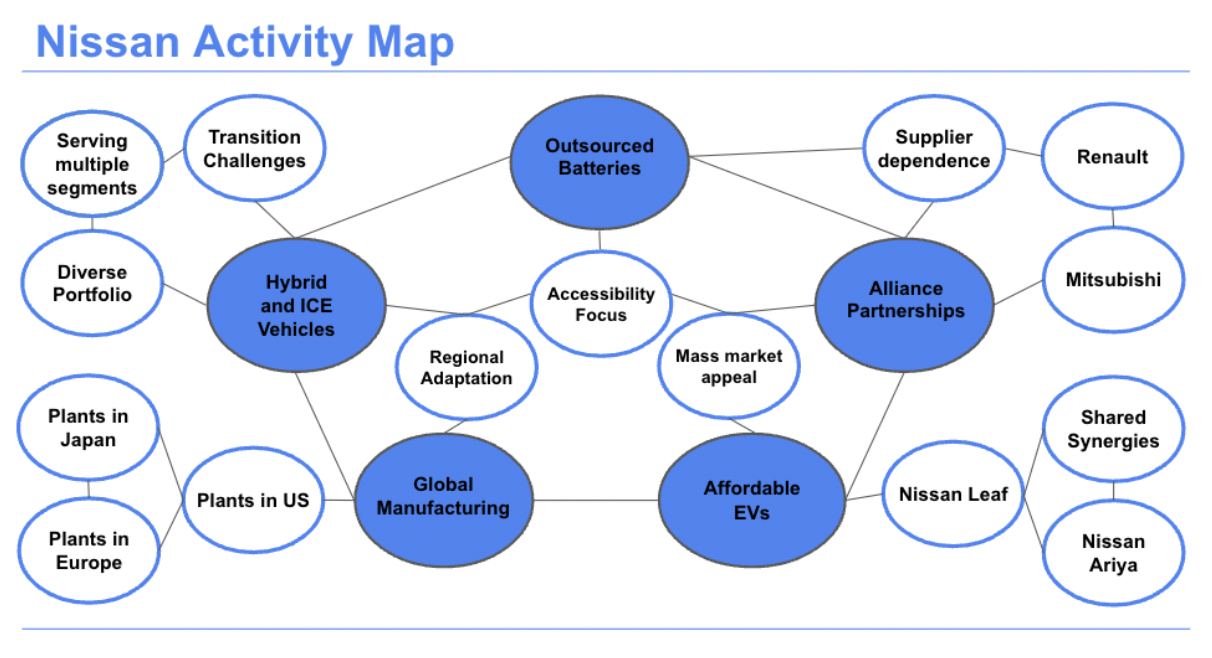

Nissan relies on a needs-based strategic positioning strategy, targeting diverse consumer segments with a portfolio that includes ICE, hybrids, and EVs. By serving a wide range of customer needs, Nissan aims to balance affordability and accessibility across global markets. However, this broad approach dilutes its focus, limiting its ability to scale innovation and production efficiencies. Nissan’s fragmented strategy is reflected in its activity map, which spans outsourced battery production, alliance partnerships, and a continued commitment to ICE and hybrid models. While Nissan’s affordability-driven strategy appeals to cost-conscious consumers, its reliance on external partnerships and shared platforms reduces its control over key differentiators, such as advanced features or proprietary infrastructure. This needs-based positioning lacks the coherence and focus of Tesla’s variety-based strategy, leaving Nissan less competitive.

Analysis

Outsourced Batteries: Nissan relies on suppliers like Envision AESC for EV battery production, reducing capital requirements but limiting control over quality and cost.

Hybrid and ICE Vehicles: Unlike Tesla, Nissan balances investments in ICE, hybrid, and EV models, diluting its EV-specific focus but serving a wider customer base.

Alliance Partnerships: The Renault-Nissan-Mitsubishi Alliance enables shared platforms and R&D, lowering costs and facilitating global expansion.

Affordable EVs: Nissan focuses on affordability, producing models like the Leaf and Ariya to target cost-conscious buyers in the mass market.

Global Manufacturing Presence: Nissan operates plants in key regions (Japan, U.S., Europe), enabling localized production and reducing export costs, though less integrated than Tesla’s vertically managed system.

Orders of Fit

Nissan demonstrates some first-order fit, with activities like producing affordable EVs, maintaining hybrid and ICE offerings, and leveraging their alliances to reduce costs. However, its fragmented focus dilutes the alignment of its strategy. The company shows limited second-order fit, as certain activities, like global manufacturing and partnerships, reinforce its affordability strategy. For example, localized production reduces costs and supports accessibility for mass-market buyers. However, the lack of synergy between ICE and EV operations prevents Nissan from fully capitalizing on these connections. Nissan lacks third-order fit, which requires optimization of its efforts. Its reliance on external suppliers for batteries reduces control over costs, and its limited innovation in software and autonomy hinders its ability to create an integrated ecosystem.

Tradeoffs and Sweet Spot

Nissan’s strategy involves several key tradeoffs as it balances affordability, alliance synergies, and the transition to EVs. By prioritizing affordable EVs, Nissan sacrifices investment in advanced features such as autonomous driving and connectivity, leaving it less competitive in premium segments. Additionally, the company’s continued focus on ICE and hybrid vehicles spreads resources thin, delaying the scale-up of EV manufacturing and R&D. While Nissan’s reliance on the Renault-Nissan-Mitsubishi Alliance helps reduce costs through shared R&D and platform development, it limits the company’s ability to differentiate itself, as shared platforms dilute branding opportunities. Furthermore, outsourcing battery production to suppliers lowers upfront costs but reduces Nissan’s control over critical components, impacting long-term cost stability and supply chain resilience.

Nissan’s sweet spot lies in its ability to target cost-sensitive consumers through affordable offerings, leveraging synergies, and using global manufacturing to localize production for regional markets. The Nissan Leaf, as one of the most affordable cars globally, exemplifies this approach by maintaining accessibility while offering basic functionality. By balancing affordability with localized production and shared R&D costs, Nissan secures a foothold in the mass-market segment. However, this strategy is constrained by its tradeoffs, leaving Nissan vulnerable to competitors who achieve greater economies of scale and technological differentiation. While Nissan’s approach ensures short-term competitiveness in the cost-sensitive segment, it lacks the scalability and innovation needed to sustain leadership.

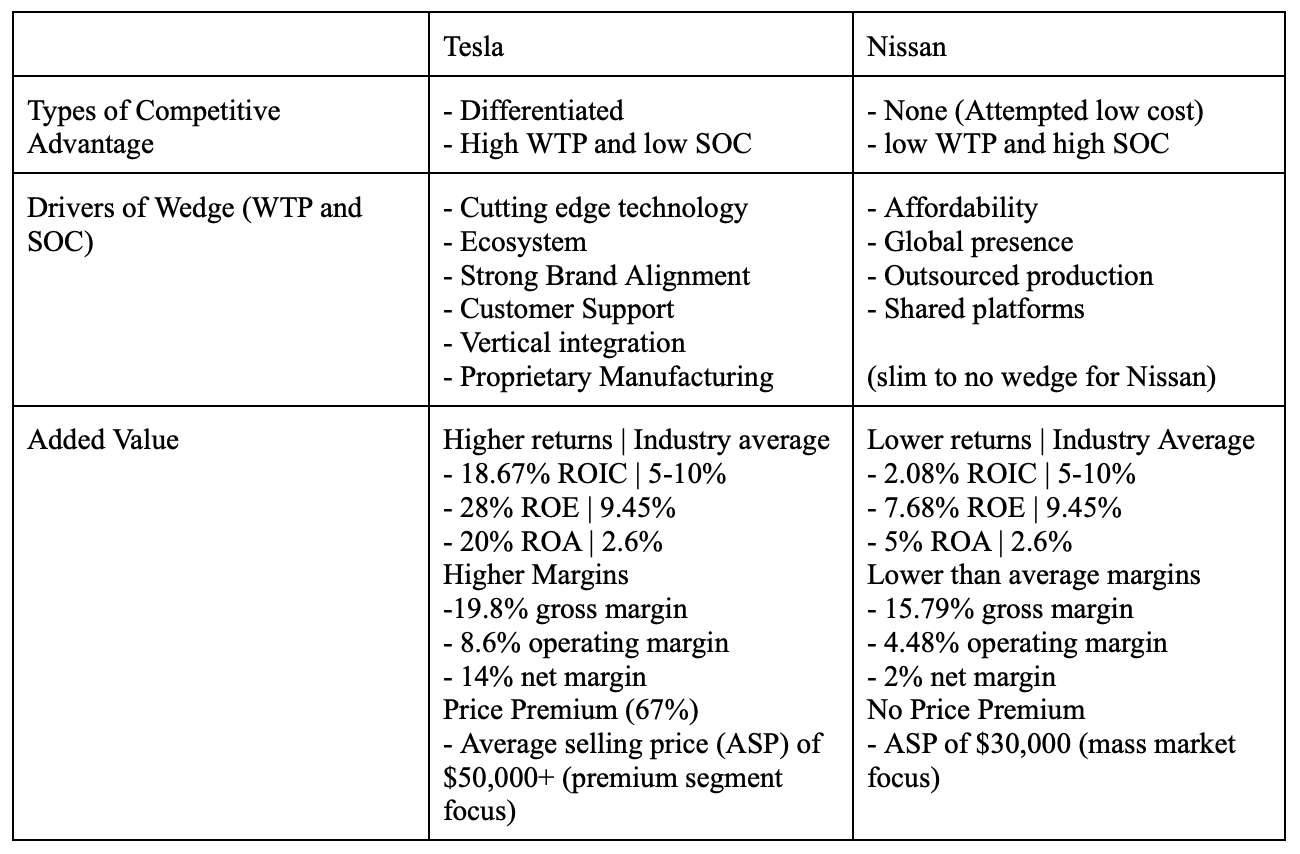

Competitive Advantage

Tesla’s differentiation strategy allows it to create a wide wedge between willingness to pay and supplier opportunity cost by focusing on innovation, vertical integration, and premium branding. Tesla achieves high margins while commanding premium prices. Tesla achieves a high ROIC (~20%) through economies of scale in EV production, proprietary software, and battery technology, which also allow it to command premium prices and margins above industry averages. Tesla’s alignment with sustainability further enhances its value proposition to environmentally conscious consumers. Nissan’s strategy, rooted in affordability and mass-market penetration, results in lower ROIC (~2%) and margins compared to Tesla and average. While the Renault-Nissan-Mitsubishi Alliance helps reduce costs through shared platforms, it limits Nissan’s differentiation. Outsourcing key components, such as batteries, further constraints profitability and innovation, leaving Nissan with no existing competitive advantage and wedge.

Activity Analysis

Value Chain - Tesla

Cost Drivers, Impact on WTP/Added Value (Tesla Form 10 Q) (Nissan Form 10 Q)

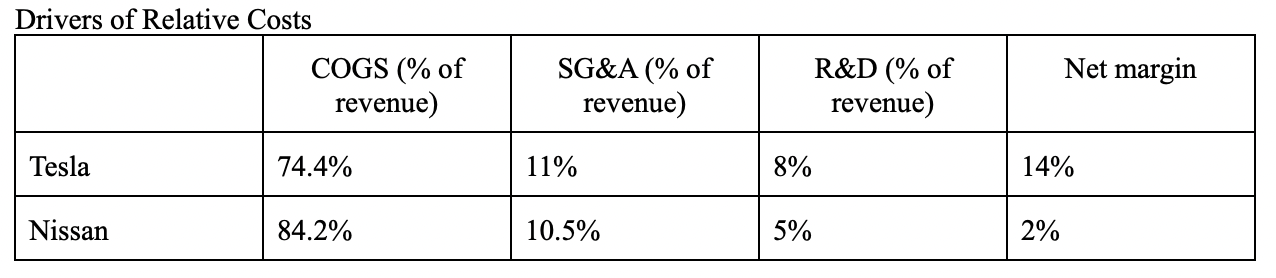

Tesla’s cost structure is heavily influenced by its vertical integration, which significantly reduces costs by eliminating reliance on third-party suppliers. Tesla’s in-house battery production at Gigafactories and integration of hardware and software enable cost efficiencies while maintaining premium pricing. Automation in manufacturing further reduces labor costs, and economies of scale allow Tesla to spread fixed costs, such as R&D and factory setup, across higher production volumes. High output from facilities like the Shanghai Gigafactory, which produces over 750,000 units annually, drives per-unit cost reductions. Additionally, Tesla’s direct-to-consumer model eliminates dealership costs, ensuring consistent pricing across markets and lowering costs. These cost efficiencies directly impact Tesla’s ability to enhance willingness to pay and add value. Technologies like Full Self-Driving, over-the-air updates, and superior range enhance perceived value, allowing Tesla to command a price premium. Tesla’s strong brand equity, associated with innovation and sustainability, adds to its WTP. Ecosystem features, such as the proprietary Supercharger network, increase customer loyalty and recurring value. As a result, Tesla achieves high operating margins and generates significant added value by maintaining low costs while pricing its vehicles at a premium.

In contrast, Nissan’s cost structure is shaped by outsourcing and a broad product portfolio. The company relies on suppliers for battery production, which reduces upfront capital investments but increases dependency and supplier costs. Nissan’s strategy of producing ICE, hybrid, and EV models adds complexity and limits economies of scale in EV production. Lower R&D spending (~5% of revenue), compared to Tesla’s 8%, constraints Nissan’s ability to innovate or reduce costs. Additionally, its focus on affordability results in cost-focused manufacturing, which often compromises advanced features. Nissan’s affordability driven strategy limits its ability to enhance WTP and create added value. The company targets cost-sensitive buyers, but limited innovation and shorter driving ranges reduce perceived value. Nissan’s reliance on affordability as its primary differentiator constrains its margins and reduces profit potential, narrowing the wedge between WTP and supplier costs.

Exploring how Tesla and Nissan Evaluate options and make choices

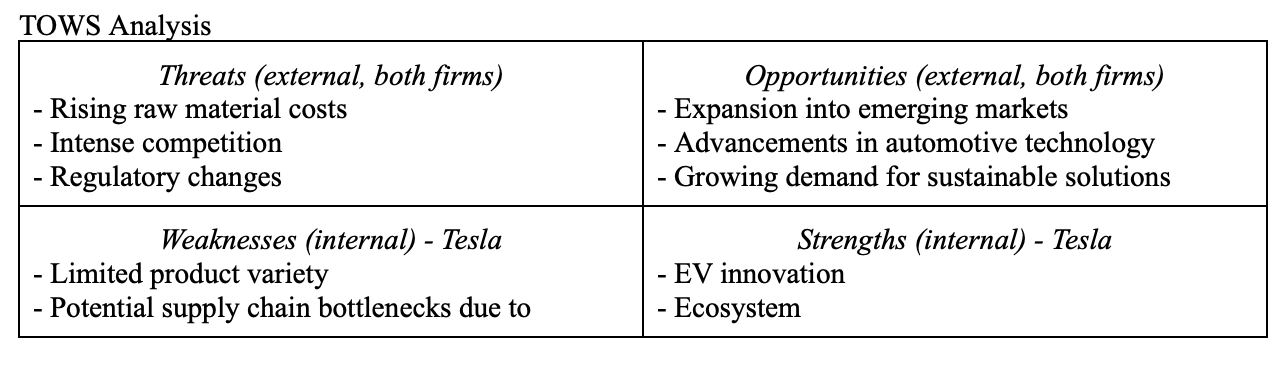

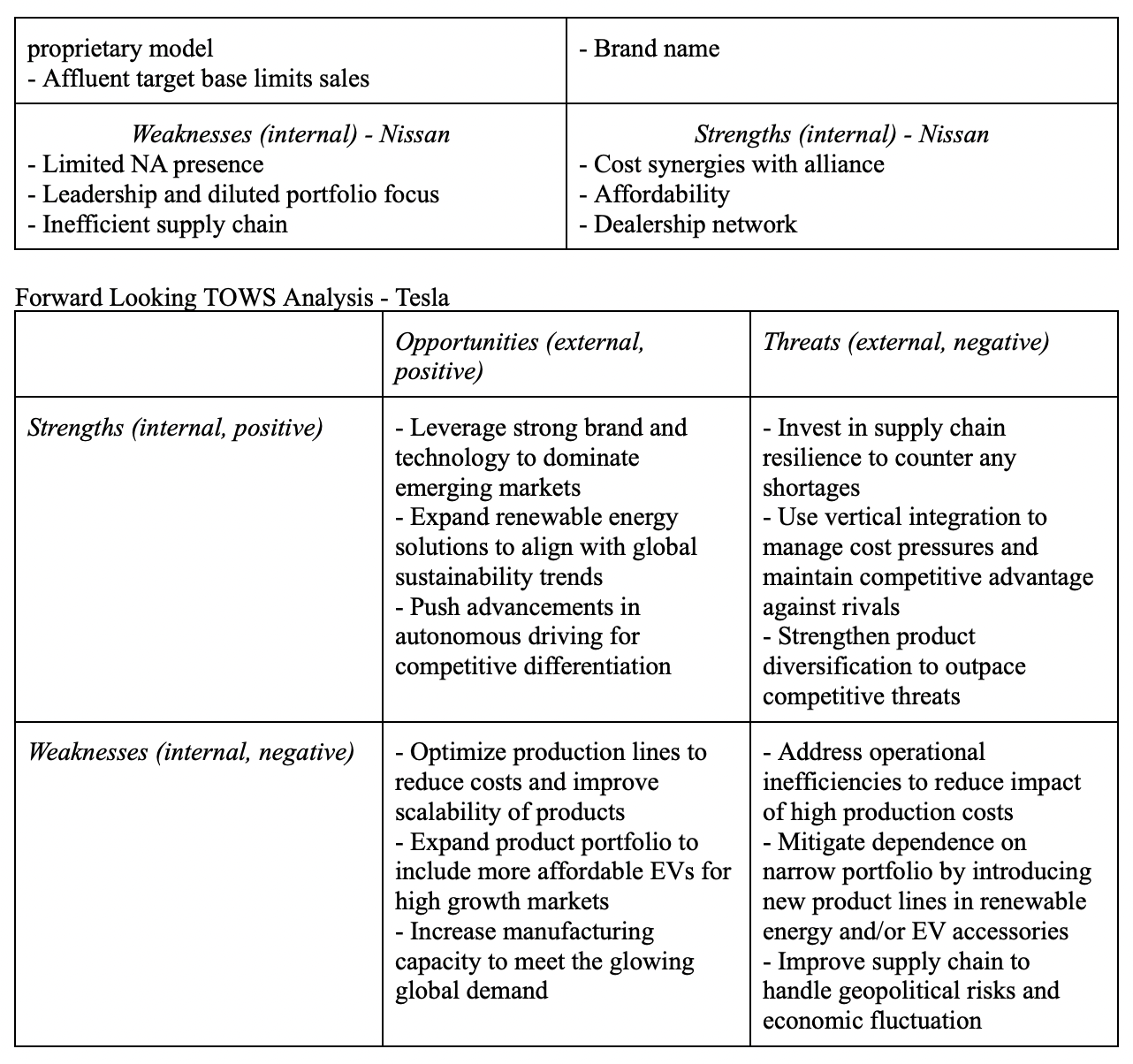

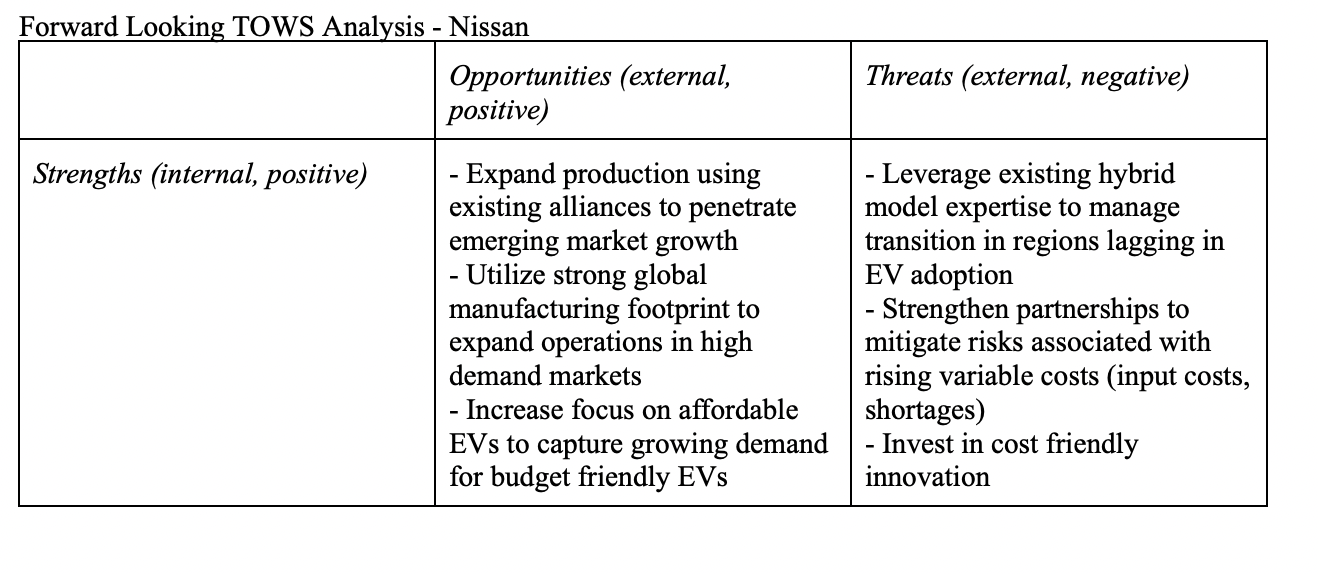

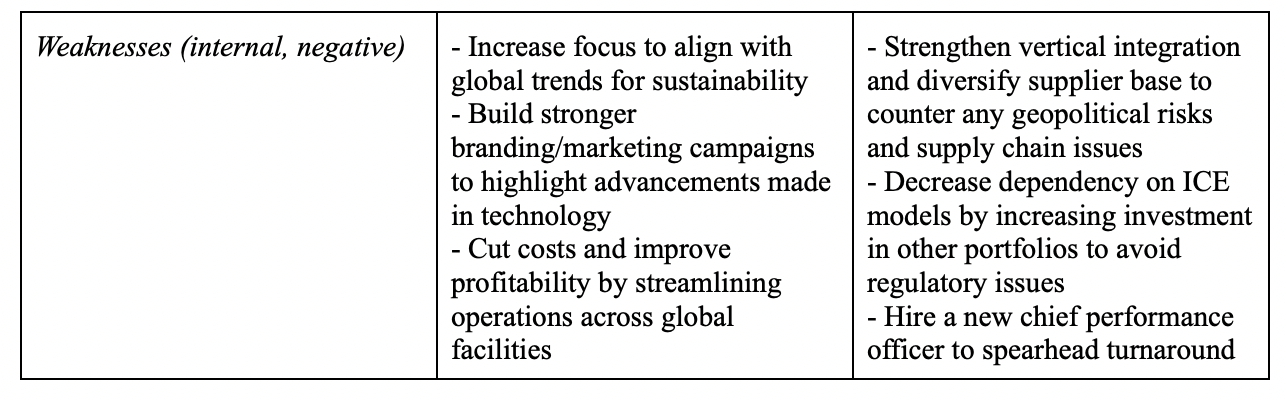

Tesla and Nissan operate in a dynamic automotive landscape filled with opportunities and threats. For Tesla, opportunities include continued expansion into emerging markets such as Southeast Asia and India, leveraging its innovative battery technology to advance EV adoption, and scaling its energy solutions business. The company's advancements in autonomous driving and the growing global demand for EVs strengthen its competitive position. However, Tesla faces challenges such as supply chain vulnerabilities, particularly in securing critical materials like lithium, and increasing competition from both legacy automakers and EV-focused companies. Regulatory scrutiny over its autonomous driving features and premium pricing in the face of economic uncertainties further add to its risks. Tesla’s decisions are made based on an attempt to pounce on new and existing opportunities, while mitigating these risks.

For Nissan, opportunities include tapping into its strength in the mass-market segment, supported by rising global demand for affordable vehicles and government subsidies promoting EV adoption. Its partnership within Renault and Mitsubishi offers cost-sharing benefits and expanded market access. However, Nissan faces threats such as lagging behind in advanced EV technology and autonomous features, as well as intensified competition from low-cost manufacturers in Asia. Additionally, its reliance on traditional dealership models and third-party charging infrastructure limits its ability to deliver the seamless customer experience that Tesla offers.

Analysis

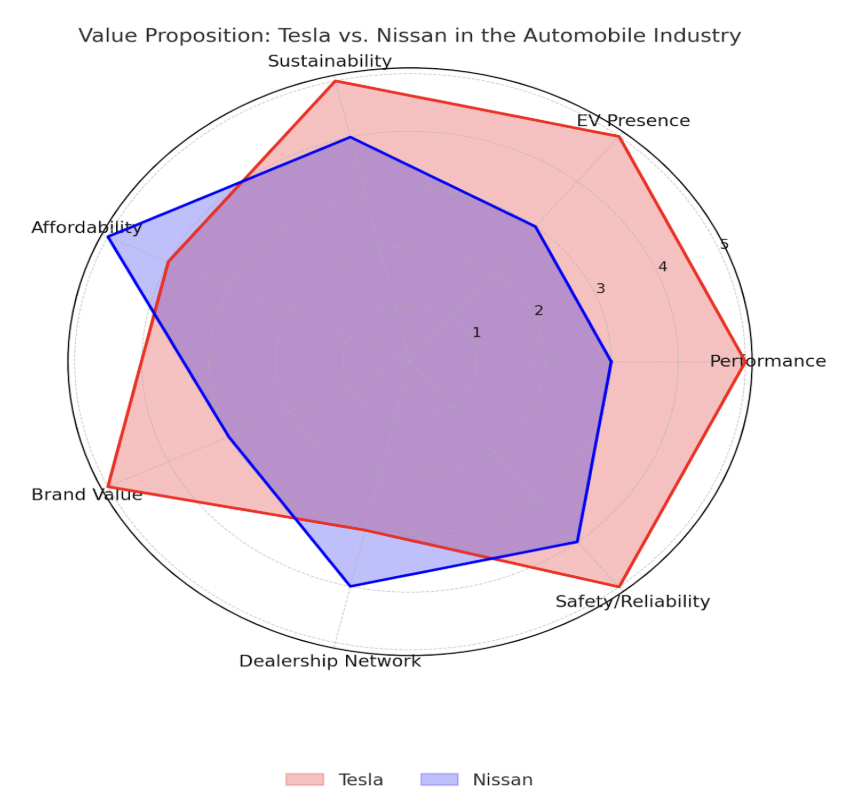

The value proposition analysis underscores the distinct positioning of Tesla and Nissan in the automobile industry, particularly in key attributes such as performance, EV presence, sustainability, affordability, brand value, dealership network, and safety/reliability. Tesla emerges as the clear leader in several critical areas. Its superior safety and reliability standards, bolstered by autonomous technology and proactive safety features, outshine Nissan's more conventional ProPILOT Assist system. Tesla’s industry-leading performance metrics, characterized by acceleration and high-speed capabilities, further cement its dominance in the premium segment.

Tesla's EV presence is underscored by its robust charging network and advanced battery technology, which supports ranges exceeding 400 miles per charge in flagship models, a stark contrast to Nissan’s EV offerings, such as the Leaf, which average around 200 miles. Additionally, Tesla’s commitment to sustainability extends beyond vehicles, encompassing renewable energy solutions like solar panels and energy storage systems. This focus resonates with environmentally conscious consumers, reinforcing Tesla's position as a sustainability leader.

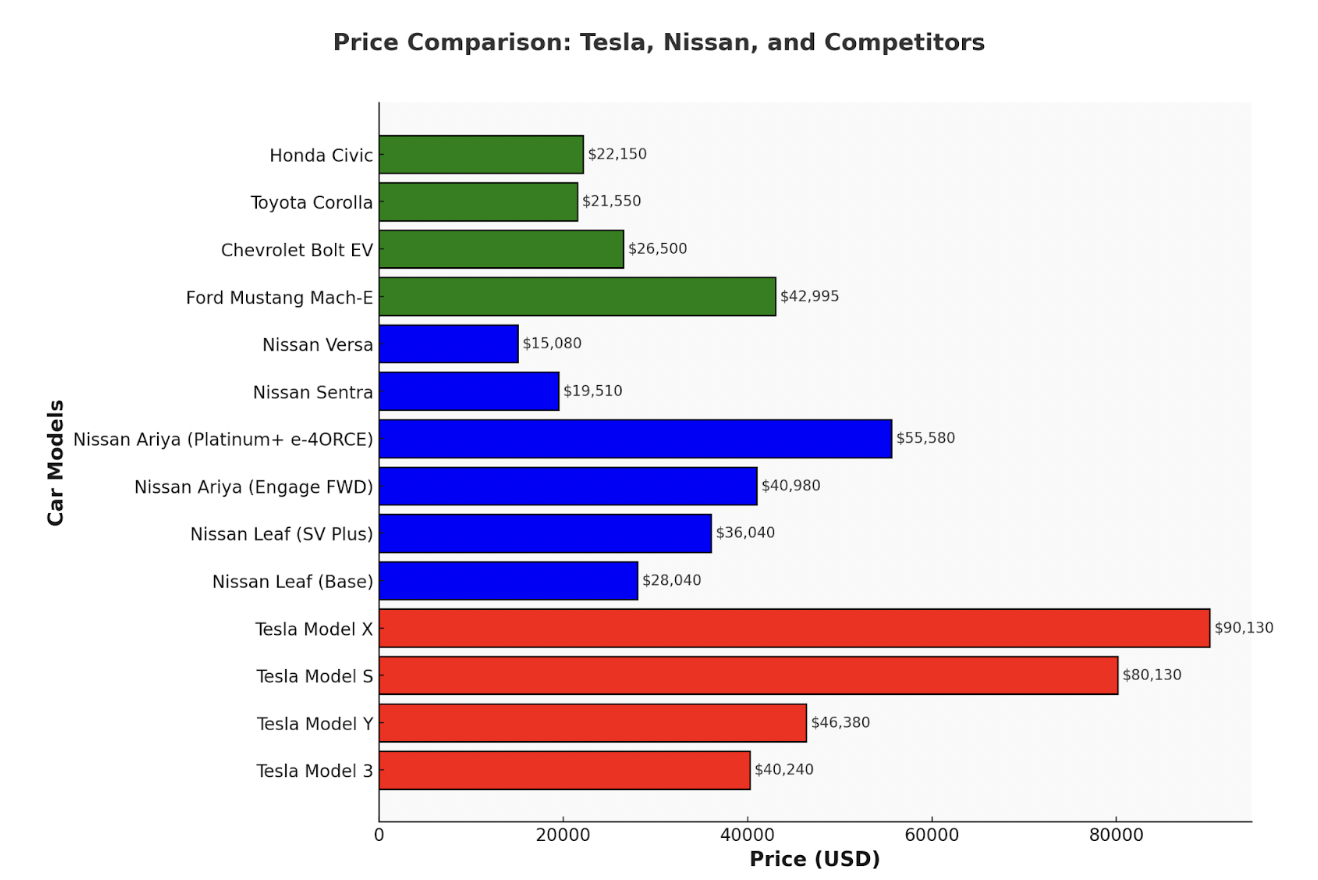

In brand value, Tesla commands significant global recognition as a premium, innovative automaker. This allows Tesla to command an ASP of over $50,000, reflecting its appeal to high-end, tech-savvy customers. However, its premium pricing strategy limits accessibility for cost-sensitive consumers, reflected in a relatively moderate affordability score.

Conversely, Nissan’s value proposition is anchored in affordability, with an ASP around $30,000, making its vehicles, such as the Versa and Sentra, accessible to budget-conscious buyers. While this affordability strategy widens its customer base, it undermines Nissan’s competitiveness in innovation-driven attributes like EV presence, safety, and performance. Nissan’s dealership network and less robust charging infrastructure further weaken its ability to meet the demands of modern buyers.

Tesla’s ability to balance premium features, sustainability, and performance while maintaining a strong safety and reliability reputation positions it as the future leader in the evolving automotive landscape. Nissan, while successful in the affordability segment, struggles to compete in innovation and premium branding, which are becoming increasingly critical in the industry.

Leadership’s Role in Tesla’s Success and Nissan Challenges

Leadership has been a defining factor in the success of Tesla and the underperformance of Nissan. Tesla’s leadership, under Elon Musk, exemplifies a combination of democratic, authoritative, and coaching styles, rooted in emotional intelligence principles, which have propelled the company to dominate the electric vehicle sector of the automotive industry. Conversely, Nissan has suffered from inconsistent leadership and a lack of clear vision, which have hindered its ability to compete effectively.

Tesla: The Impact of Effective Leadership (Emotional Intelligence, Goleman)

Elon Musk's leadership at Tesla exemplifies a blend of democratic, authoritative, and coaching styles, as outlined in Goleman’s leadership framework. His authoritative approach, driven by a clear and compelling vision of transitioning to sustainable energy, has been paramount in uniting Tesla’s workforce around a mission. By articulating this vision and embedding it in Tesla’s strategy, Musk fostered a culture of clarity and commitment, encouraging employees to align their efforts with the organization’s goals. Clarity has led to groundbreaking innovations, including industry-leading battery technology and advanced autonomous driving capabilities, solidifying Tesla’s competitive advantage. Musk’s democratic leadership style is evident in his willingness to engage with teams and empower employees to contribute to Tesla’s strategic direction. By fostering open communication and collaboration, Musk enables employees to take ownership and drive innovation within the organization. This approach is reinforced by Tesla’s commitment to employee development through R&D investment and cross-functional projects, creating a culture of shared responsibility. Additionally, Musk’s coaching leadership style emphasizes continuous learning and growth. By nurturing top talent and encouraging creativity, Tesla has been able to attract and retain the brightest minds in engineering, AI, and sustainability. These efforts reflect Musk’s focus on developing others and fostering emotional intelligence competencies such as empathy and inspiration. Tesla’s workplace culture, characterized by high flexibility, responsibility, and standards, shows the effectiveness of Musk’s leadership style. Employees are encouraged to innovate, take initiative, and meet ambitious performance benchmarks, all while remaining aligned with Tesla’s mission. This climate of empowerment and accountability has enabled Tesla to outpace competitors and maintain its position as a leader in the EV and sustainable energy sectors. Musk’s ability to inspire, engage, and develop his team, aligns with emotional intelligence principles and ensures Tesla remains at the forefront of innovation and excellence.

Nissan: The Consequences of Ineffective Leadership (Emotional Intelligence, Goleman) (Reuters)

Nissan’s leadership challenges stem from a combination of inconsistent vision, unclear priorities, and a rigid organizational climate, undermining the company’s ability to adapt to market demands. The departure of CEO Carlos Ghosn created a leadership vacuum, leading to fragmented strategies and low employee morale. Current CEO Makoto Uchida has faced mounting pressure to reverse this decline amidst financial challenges and operational missteps. In November 2024, Uchida announced cost-cutting measures, including reducing 9,000 employees, cutting 20% of global production capacity, and slashing $2.6 billion in costs. Uchida’s tenure has been marked by persistent questions about Nissan’s direction. During an October meeting with managers, Uchida acknowledged that business conditions were worse than expected, citing weak sales and profitability in North America and China. Questions were raised about Nissan’s failure to hedge its EV strategy, a glaring oversight as hybrid demand surged due to high prices and limited charging infrastructure. Employees and analysts criticized leadership for misreading trends and failing to capitalize on early successes. Instead, competitors like Tesla have captured market share, leaving Nissan scrambling to stay relevant. Nissan’s reliance on coercive leadership styles, focused on compliance and cost-cutting, has stifled innovation and adaptability. Employee surveys reveal

dissatisfaction with the organizational climate, citing unclear goals, low flexibility, and minimal accountability. Nissan’s leadership has struggled to communicate a compelling vision. Activist investors have built stakes in the company, adding to pressure on Uchida to deliver a turnaround. Efforts to cut costs, including potential factory closures, reflect Nissan’s attempts to adapt and highlight the company’s inability to respond to shifting consumer demands. Nissan’s leadership has failed to foster a culture conducive to collaboration and performance, leaving them vulnerable in an increasingly competitive landscape. While Tesla’s leaders harness a mix of affiliative, democratic, and coaching styles to adapt to challenges, Nissan’s lack of emotional intelligence and reliance on coercive measures highlight the need for more dynamic leaders.

Social Responsibility (Dual Purpose Playbook)

Social responsibility and the integration of dual purpose goals, focusing on environmental, social, and financial outcomes, are crucial for understanding how Tesla and Nissan approach ESG. Both companies employ distinct strategies for managing and embedding these principles into their operations.

Tesla (Tesla Annual Impact Report, 2024)

Setting clear dual goals and monitoring progress: Tesla clearly outlines its commitment to accelerating the world’s transition to sustainable energy. This goal is measurable through its annual impact report, which tracks metrics like carbon emissions saved by its EVs and the expansion of solar and battery systems. KPIs such as gigawatt-hours (GWh) of battery storage installed and progress in recycling initiatives showcase Tesla’s dedication to combining profitability with environmental responsibility.

Structuring the organization to support both goals: Tesla’s organizational structure emphasizes integration between social goals and profitability. The company has a heavy focus to enhance sustainable innovations, such as a new battery and energy efficiency initiative. Tesla’s vertical integration allows for alignment between environmental goals and cost efficiency. Additionally, the organization is primed to revolve any issues that arise. Tesla prides itself on its open dialogue and flat structure, allowing conflict and tensions to be mitigated.

Hiring and socializing employees to embrace the mission: Tesla fosters an innovation-driven culture, attracting talent aligned with its dual mission. Tesla employs all three approaches of hiring: hybrid, specialized, and blank slate. Tesla uses a hybrid approach to blend innovation focused roles with the operational needs they have. Also, Tesla places emphasis on specialized roles, targeting niche talent and skills in areas such as AI, batteries, and manufacturing. Furthermore, the company uses a blank slate philosophy for some roles, and hires individuals who demonstrate strong alignment with the mission, despite limited experience. Tesla utilizes open and transparent communication, with Elon Musk regularly engaging employees through company wide emails and addresses. In addition, Tesla organizes team building retreats and training programs, such as those in Giga-factories. As for compensation, Tesla maintains competitive packages to incentivize employees performance and loyalty. The favorable ratio of CEO to employee pay reflects the mission-driven structure that emphasizes rewards linked to long term performance.

Leadership decision making and alignment: Tesla’s leadership displays dual-minded governance, emphasizing both purpose and profit goals. Elon Musk’s decisions, such as scaling Gigafactories globally or entering markets with high EV adoption potential, align with the financial and environmental goals of the company. Tesla’s board actively monitors its ESG performance. The board has the authority to utilize checks and balances, making the company not solely run by the CEO entirely. Board members are sure to integrate sustainability into corporate governance, to see that the goals are being met, despite challenges that may arise to generate wealth for its shareholders.

Nissan (Nissan Sustainability Report, 2024)

Setting clear dual goals and monitoring progress: Nissan follows its “Nissan Ambition 2030” plan, which focuses on expanding EV adoption and achieving carbon neutrality by 2050. The plan integrates financial performance with environmental objectives , such as reducing CO2 emissions from its operations and vehicles. Progress is monitored through its annual sustainability disclosures, although less comprehensively than Tesla.

Structuring the organization to support both goals: Nissan’s organizational structure supports a mixed strategy that includes its ICE and EV portfolios. While this approach may be flexible, it diluted the focus on sustainability compared to Tesla. The company collaborates with partners to share EV development costs, reflecting the cost-driven approach to sustainability goals. Nissan resolves conflict/tension through these same partnerships, which provide structured approaches to managing differences. The framework they have involves a shared decision making process and defined areas of responsibility for their employees. Additionally, the global operations network allows Nissan to shift resources or adapt operations to minimize conflicts caused by any market related challenges. There is a focus on accountability, which Nissan uses to mitigate tensions, even though some employees view this as hypocritical based on the company’s management struggles.

Hiring and socializing employees to embrace the mission: Nissan adopts a hybrid hiring approach, balancing the need for traditional automotive expertise with roles supporting the development of new technologies. The company hires talent for its engineering, manufacturing, and design divisions while maintaining a focus on scaling global operations. Specialized hiring is a key aspect of Nissan’s strategy, particularly in areas like battery technology and EV infrastructure, as demonstrated by its partnerships to advance EV ecosystems. At the same time, Nissan employs a conservative approach for some roles, favoring candidates with proven industry experience to maintain consistency in its operations. Nissan emphasizes employee socialization through clear communication of corporate objectives and frequent training programs, particularly in EV technologies and quality assurance. The company does its best to foster collaboration via open conversations, team-building activities, and partnerships. Additionally, Nissan aligns compensation with performance metrics to motivate employees.

Leadership decision making and alignment: Nissan has faced significant struggles in leadership and decision making, stemming from the complex alliance structure. This has created tension and a bottleneck in fast decision making. The instability has made these challenges difficult to manage. Even though this is the case, Nissan’s focus aims to balance legacy operations with EV investments. The existing management structure favors a conservative approach, counteracting the goals of heavy R&D/ESG investments. The board’s focus is evolving but it lacks the direct intensity that Tesla’s governance model has, making them fall behind in this aspect of the Automotive industry.

Future Positioning

Financial performance and returns (Associated Press) (Tesla, Nissan Form 10-Q)

Tesla’s financial metrics illustrate its dominant positioning in the premium EV market and its ability to deliver superior returns. Tesla’s ROIC (18.67%), ROE (28%), and ROA (20%) far outpace Nissan’s ROIC (2.08%), ROE (7.68%), and ROA (5%), highlighting Tesla’s capital efficiency and ability to create shareholder value. Tesla’s gross margin (20%), operating margin (8.6%), and net margin (14%) also significantly exceed Nissan’s gross margin (15.79%), operating margin (4.48%), and net margin (2%). This performance is driven by Tesla’s vertically integrated business model, which reduces costs and enhances profitability, as well as its software-driven vehicle offerings that maximize value.

Nissan is facing significant financial and operational challenges, highlighted by its fiscal second-quarter loss of 9.3 billion yen ($60 million), a reversal from a profit of 190.7 billion yen in the same period last year. Quarterly sales declined to 2.9 trillion yen ($19 billion), driven by falling demand, surging costs, and underperformance in key markets like the U.S. The company has lowered its full-year revenue forecast to 12.7 trillion yen ($82 billion) and revised its vehicle sales projection to 3.4 million units, reflecting stagnation. These challenges underscore Nissan’s difficulty in navigating the transition to EVs and its dependence on lower-priced mass-market segments, which constrain its margins and profitability.

Tesla’s higher ASP of $50,000+ enables it to command a price premium in the premium EV segment. In contrast, Nissan’s ASP of $30,000 reflects its focus on affordability and mass-market appeal, limiting its profitability and leaving it vulnerable to intense competition. These metrics highlight the differences between the two companies: Tesla leverages innovation and operational efficiency to dominate the premium EV market, while Nissan struggles to adapt its cost structure and capitalize on emerging market trends.

Competitive advantage and market positioning

Tesla’s competitive advantage is rooted in its variety based strategic positioning, innovation, vertical integration, and focus on the EV market. By controlling key elements of its supply chain, such as battery production, and offering unique value propositions like over-the-air updates and Full Self-Driving software, Tesla has an ecosystem that maximizes customer willingness-to-pay. Its premium positioning enables it to attract affluent customers, solidifying its position in the high-margin EV segment.

Nissan, on the other hand, operates in a fragmented market, producing both ICE and EV vehicles. While this strategy appeals to a broad audience, it dilutes the company’s focus on electrification and innovation, leaving them with no competitive advantage. Nissan lacks Tesla’s technology and brand, and its reliance on mass-market vehicles magnifies its struggle to maintain competitive margins and attract a loyal customer base willing to pay a premium.

Technological Innovation and Ecosystem Development

Tesla’s leadership in technological innovation sets it apart from Nissan. Tesla has pioneered advancements in battery efficiency, range, and energy storage through its proprietary battery technologies and Gigafactory network. Its ability to produce EVs at scale with high energy density and efficiency gives it a clear technological edge. Also, Tesla’s focus on software integration, adds a recurring revenue stream and locks customers into its ecosystem.

In contrast, Nissan has not demonstrated technological leadership. While the Nissan Leaf was an early entrant in the EV market, Nissan has failed to build on that momentum. Tesla’s investment in autonomous driving, charging networks, and renewable energy solutions further solidifies its ecosystem dominance, whereas Nissan remains reliant on traditional automotive manufacturing with limited innovation.

Strategic Focus and Leadership

Tesla’s strategic focus on the premium EV market aligns with global trends toward sustainability and electrification. This singular vision, supported by strong leadership under Elon Musk, has enabled Tesla to scale rapidly and maintain a clear competitive edge. Tesla’s investments and plans to launch a more affordable EV in the future reflect its long-term strategy to expand its addressable market while maintaining profitability.

Nissan, however, has struggled with leadership instability and a lack of cohesive strategy. Following the Carlos Ghosn scandal, Nissan’s leadership has faced challenges in aligning the organization’s goals with the industry’s transition to EVs. Nissan’s continued reliance on ICE vehicles and its lack of a differentiated EV strategy leave it vulnerable to disruption, particularly as global regulations tighten and consumer preferences shift toward sustainability.

Future readiness and market trends

The global automotive industry is undergoing a significant shift towards electric vehicles, driven by government regulation, consumer demand, and the rise of ESG technology. Tesla’s strong position in the EV market positions them to lead this transition. Its high margins and returns provide the needed financial strength to continue investing in R&D and expanding its global manufacturing and charging ecosystem. Tesla’s ability to innovate rapidly and enter new markets ensures its leadership in a future dominated by electrification.

Nissan faces many headwinds in this transition. The reliance on ICE vehicles as a segment limits the ability to adapt to the ever changing emission standards. Also, the EV lineup lacks the scale and technological edge needed to compete with EV focused automakers. While Nissan’s lower cost vehicles appeal to price sensitive consumers, the profitability of ICE vehicles is shrinking. Increasing competition in the mass market segment will further constrain Nissan’s long term growth, likely leading to continued profitability issues.

Conclusion

Based on a thorough analysis of both companies’ competitive positioning, financial performance, and alignment with industry trends, Tesla is better positioned for the future than Nissan. Tesla’s superior returns, innovation-driven business model, leadership, and ability to capitalize on the EV transition give it a dominant and sustainable edge over Nissan.

Works Cited:

Automotive Industry Insights—Spring 2024. Kroll, authored by Kroll Automotive Team, May 2024, https://www.kroll.com/en/insights/publications/m-and-a/automotive-industry-insights-spring-2024.

Automotive Industry Trends. PwC, authored by PwC Industrial Products Group, https://www.pwc.com/us/en/industries/industrial-products/library/automotive-industry-trends.html.

FactSet. Key Financial Metrics for Tesla and Nissan. Authored by FactSet Research Analysts, 30 Sept. 2024.

Goleman, Daniel. Emotional Intelligence: Why It Can Matter More Than IQ. Bantam, 1995.

Global Electric Vehicle Outlook 2024. International Energy Agency (IEA), authored by the IEA EV Team, 2024, https://www.iea.org/reports/global-ev-outlook-2024.

Shirouzo, Norihiko. "Nissan Boss Uchida Races to Save Automaker and His Job." Reuters, 5 Dec. 2024, https://www.reuters.com/business/autos-transportation/nissan-boss-uchida-races-save-automaker-his-job-2024-12-05/.

Kageyama, Yuri. "Nissan Posts Loss as Challenges Persist for Automaker." AP News, Associated Press, 3 Dec. 2024, https://apnews.com/article/nissan-japan-renault-automaker-loss-b6fa5d02770a13908ecec11b6a9f8e8f.

Nissan Motor Co., Ltd. “Sustainability Report 2024.” Authored by Nissan Sustainability Team, Nissan Global, https://www.nissan-global.com/EN/SUSTAINABILITY.

Nissan Motor Co., Ltd. Form 10-K. Nissan Global, filed 31 March 2024, https://www.nissan-global.com.

Nissan Motor Co., Ltd. Form 10-Q. Nissan Global, filed 30 Sept. 2024, https://www.nissan-global.com.

Red letter T abstract minimalist logo example Tesla. (n.d.). Logofav.com. Retrieved June 3, 2025, from https://www.logofav.com/logo/red-letter-t-abstract-minimalist-logo-example-tesla

S&P Capital IQ Net Advantage: Tesla Inc. Financial Metrics. Authored by S&P Global Analysts, S&P Global Market Intelligence.

S&P Capital IQ Net Advantage: Nissan Motor Co. Ltd. Financial Metrics. Authored by S&P Global Analysts, S&P Global Market Intelligence.

Tesla, Inc. “Annual Impact Report 2024.” Authored by Tesla Environmental Impact Team, Tesla Investor Relations, https://www.tesla.com/impact.

Tesla, Inc. Form 10-K. Tesla, Inc., filed 31 Dec. 2023, https://ir.tesla.com.

Tesla, Inc. Form 10-Q. Tesla, Inc., filed 30 Sept. 2024, https://ir.tesla.com.

U.S. Department of Energy. “The Future of Battery Technology.” Authored by U.S. Department of Energy Battery Research Division, Energy.gov, https://www.energy.gov/batteries.

Waymo. “The Future of Autonomous Driving.” Authored by Waymo Autonomous Development Team, Waymo Blog, https://blog.waymo.com/.

(Potts, Jeremiah, Strategic Management 3099, Boston College)